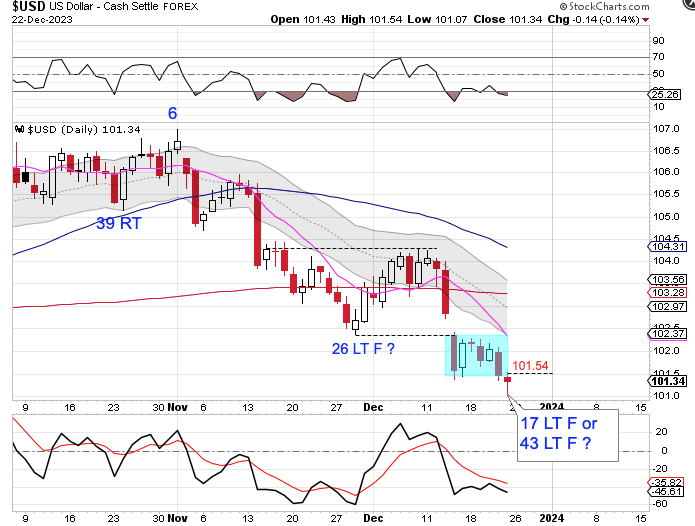

Dollar

The dollar broke bearishly out of consolidation on Friday to extend the daily cycle decline.

The status of the daily cycle is not clear. The dollar is either in the early part of its timing band for a DCL or deep in its timing band for a DCL. A bearish break out of consolidation should lead to a 5 – 7 day bloodbath phase. However the dollar formed a bullish reversal on Friday. A swing low and close back in the consolidation zone would signal a new daily cycle. We will need to see a close above the 10 day MA to label Friday as the DCL. The dollar is currently in a daily downtrend. The dollar will remain in its daily downtrend unless it closes back above the upper daily cycle band.

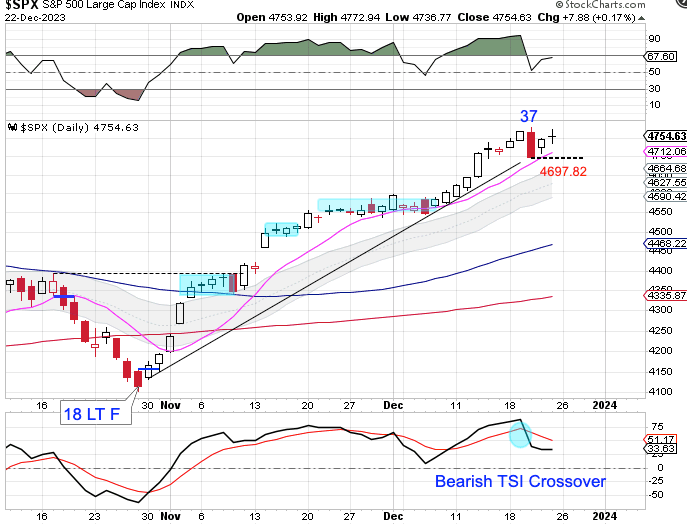

Stocks

Stocks formed a bearish reversal on Wednesday

Wednesday was day 37 for the daily cycle. That places stocks in its timing band for a daily cycle decline. A break below 4697.82 will form a swing high. Then a close below the 10 day MA will signal the daily cycle decline. Stocks are currently in a daily uptrend. Stocks will remain in its daily uptrend unless they close below the lower daily cycle band.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.