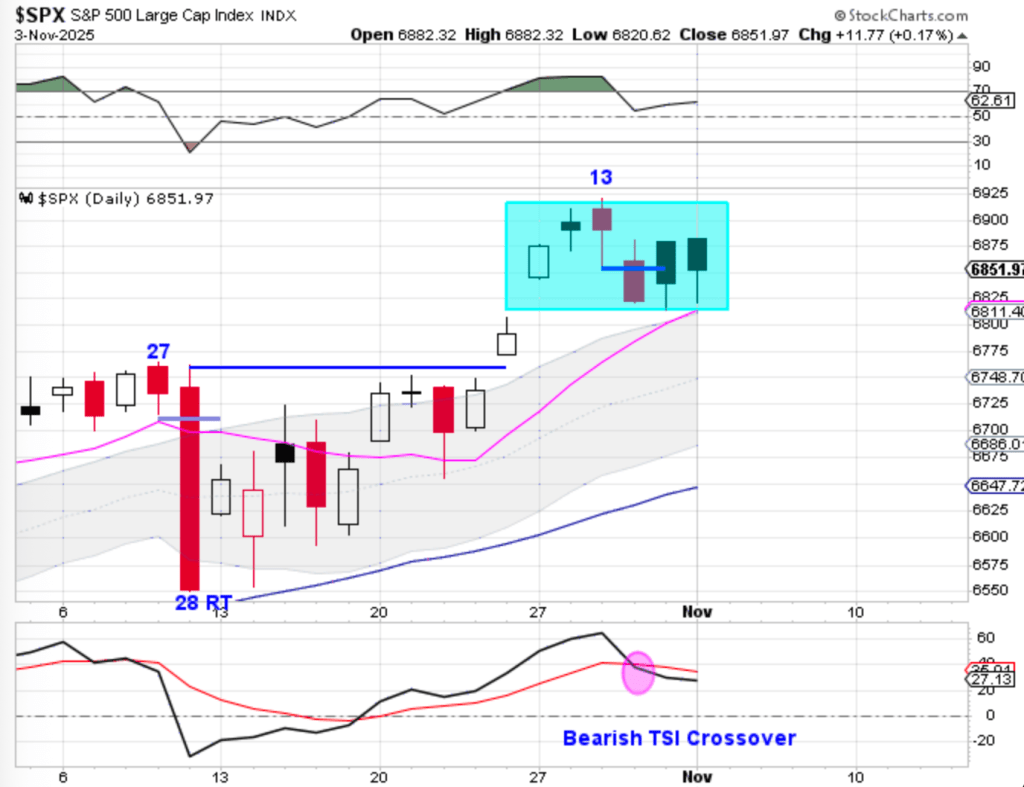

Stocks became stretched above the 10 day moving average last week on day 13. Since then, the market has been consolidating, allowing the 10-day MA to catch up to price. This pause has helped relieve short-term overbought conditions while maintaining structure within the daily uptrend.

Stocks remain in a confirmed daily uptrend. A bullish breakout from the current consolidation would indicate a continuation of that trend and trigger a cycle band buy signal.

However, it’s important to note that stocks are now deep in their timing band for an intermediate cycle decline. The day 13 peak still leaves open the possibility of a left-translated daily cycle formation, which could lead to a more significant downturn. A bearish breakout from consolidation — particularly a close below the 10 day MA — would signal that shift and set the stage for a potential intermediate cycle decline.

Leave a reply to likesmoneystudies Cancel reply