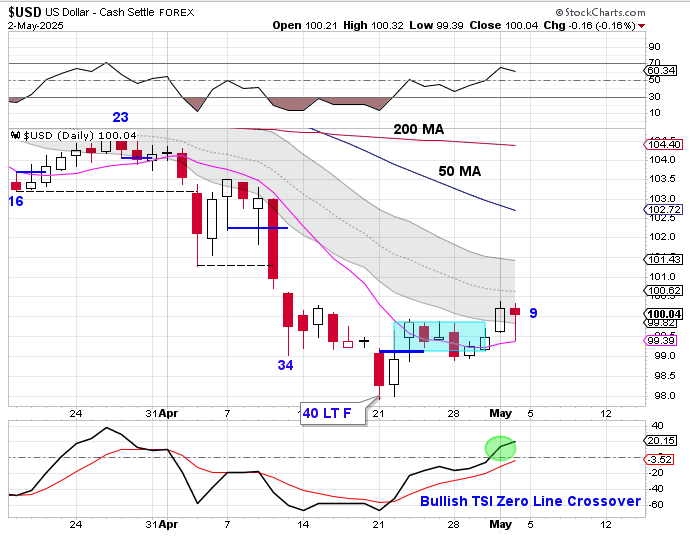

The dollar had been consolidating along the 10 day MA — until Thursday. The dollar broke bullishly out of consolidation on Thursday. The dollar then back-tested the 10 day MA on Friday, turning it higher. If the dollar has begun a new intermediate (weekly) cycle, then the first daily cycle should right translate and close above the upper daily cycle band. The dollar is currently in a daily downtrend. The dollar will remain in its daily downtrend unless it closes above the upper daily cycle band.

Stocks were consolidating below the 50 day moving average until —Thursday. Stocks close above the 50 day moving average on Thursday and closed higher again on Friday. Stocks remain in the 5550 – 5700 resistance zone. They could also find resistance from the 200 day MA. No trending move we be able to gain traction until stocks can close above the 200 day MA. Stocks also closed above the upper daily cycle band. Closing above the upper daily cycle band ends the daily downtrend and begins a daily uptrend. Closing above the upper daily cycle band also signals that the ICL has been set.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

Subscribers click here.

Leave a comment