Stocks broke below support from the previous DCL on Friday. At 18 days, stocks still had 2 – weeks before being in their timing band for a DCL.

So with stocks in a failed daily cycle, the expectation was for stocks to continue lower until the DCL forms. However, stocks delivered a bullish surprise on Monday. Stocks formed a swing low on Monday, recovering the breakdown level from the June DCL. But stocks were met with resistance by the sharply declining 10 day MA.

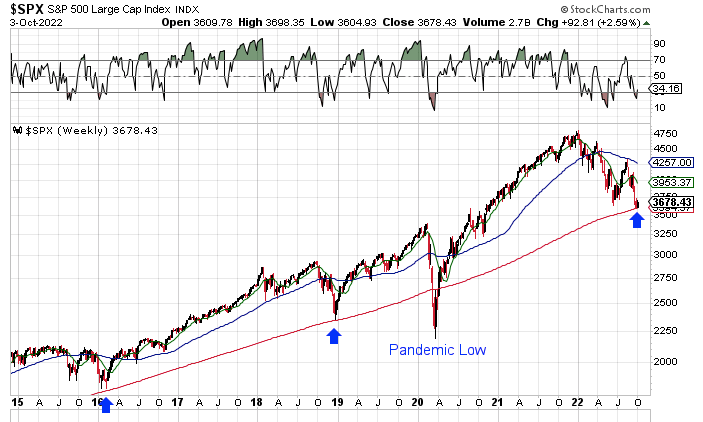

Aside from the pandemic low (which was also a 4 year cycle low) stock have been finding consistent support at the rising 200 week MA. So a close above the 10 day MA would signal a possible early DCL – using Friday as the stop. But a close below the 200 week MA would indicate a decline into a 4 year cycle low.

Leave a reply to likesmoneystudies Cancel reply