Summary

- The dollar has broken above key resistance at 99.2, confirming bullish continuation.

- Momentum remains stretched short term, but trend structure favors higher prices.

- The daily uptrend remains firmly intact.

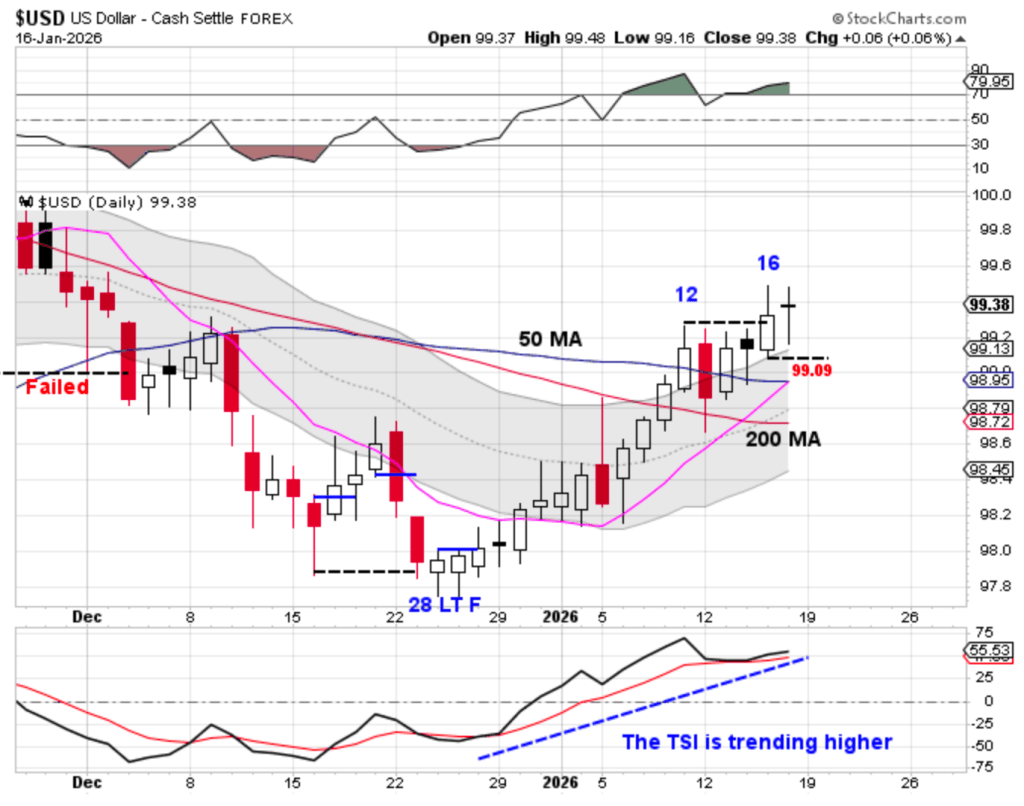

After closing above the 50 day moving average on Friday, the dollar spent several sessions consolidating below the 99.2 resistance level. That consolidation resolved bullishly on Thursday, with a decisive close above resistance, followed by additional upside follow-through on Friday.

The dollar is currently extended above the 10 day moving average, suggesting near-term consolidation may be needed to allow the short-term average to catch up to price. That said, price action remains constructive, and no technical damage has occurred.

A sustained close above the 99.2 level confirms a continuation of the daily uptrend and triggers a cycle band buy signal. Until price closes back below key support levels, pullbacks should be viewed as corrective within a broader bullish structure.

Takeaway

The breakout above 99.2 confirms trend continuation. While short-term consolidation is possible due to extension above the 10 day moving average, the daily uptrend remains in control.

Leave a comment