Summary

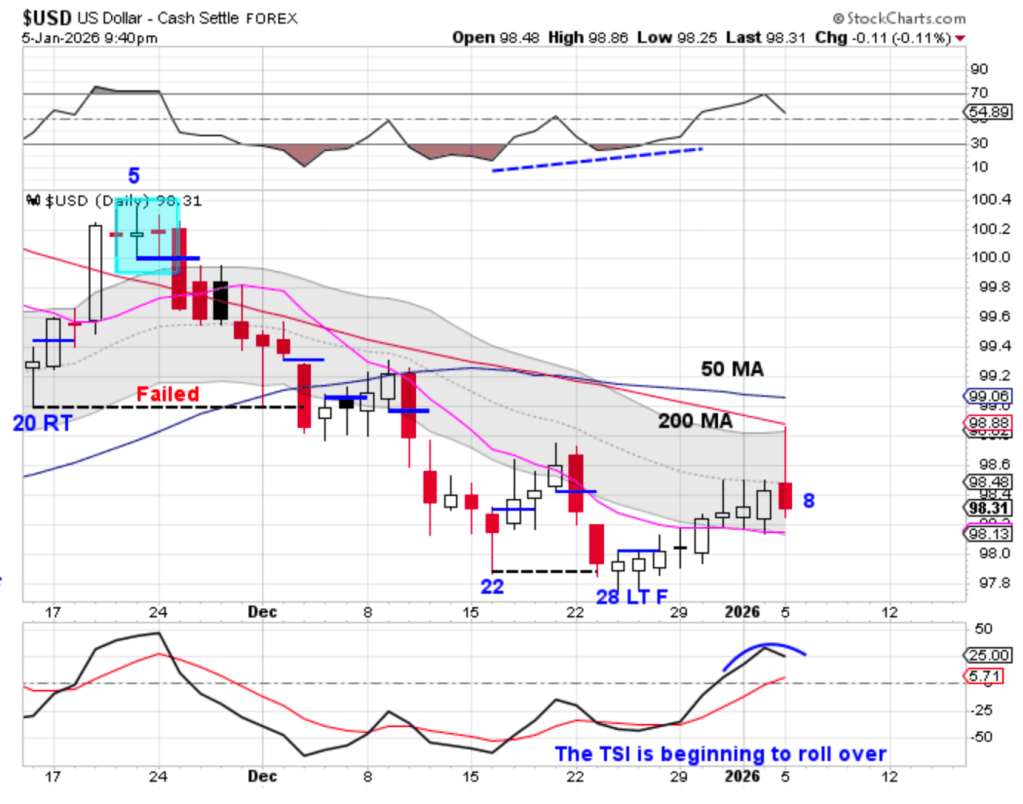

- The dollar was rejected at resistance at the 200 day moving average

- A peak on day 8 raises the risk of a left-translated daily cycle

- The dollar remains in a daily downtrend

- A close below the 10 day moving average would signal continued daily cycle weakness

- A break below 97.75 would extend the intermediate cycle decline

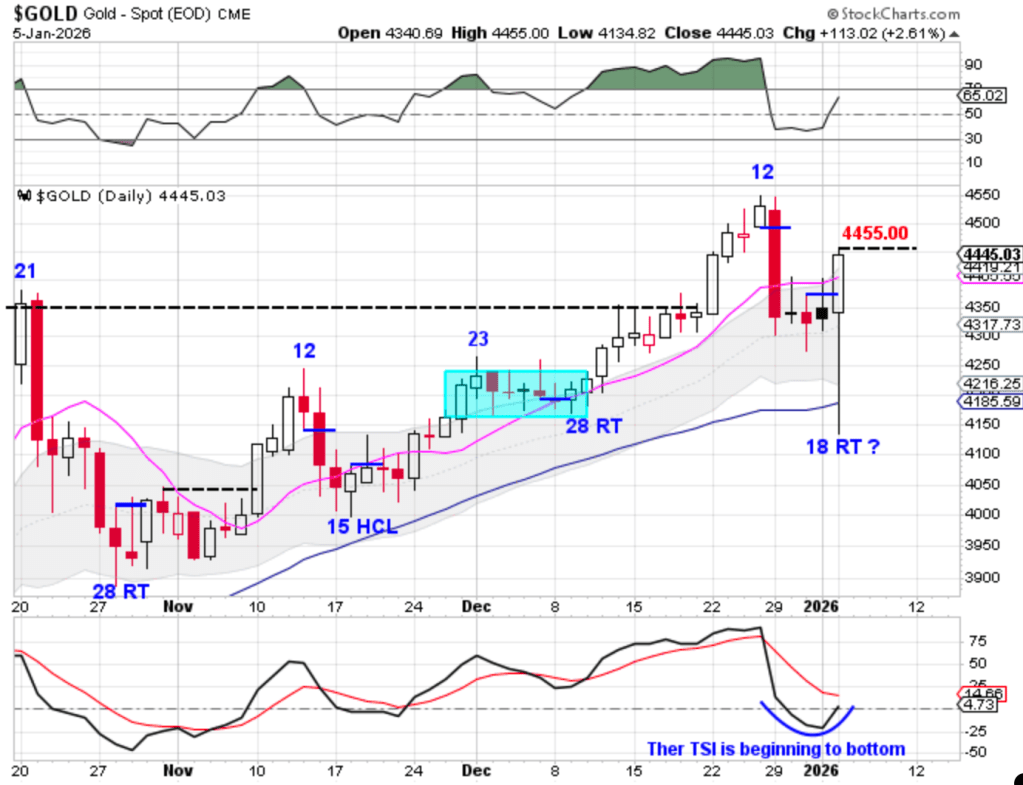

- Gold formed a bullish reversal following dollar weakness

- Day 18 places gold in the early part of its timing band for a DCL

- A confirmed swing low would label day 18 as the DCL

- Gold remains in a daily uptrend with a cycle band buy signal

The dollar was rejected by the 200 day moving average on Monday, reinforcing resistance at a key longer-term level. A peak on day 8 sets the dollar up for a possible left-translated daily cycle formation. The dollar remains in a daily downtrend.

A swing high followed by a close below the 10 day moving average would indicate a continuation of the daily cycle decline and signal a cycle band sell signal. A break below the prior DCL at 97.75 would extend the intermediate (weekly) cycle decline.

Gold responded to the dollar’s rejection with a bullish reversal on Monday, closing back above the 10 day moving average. Monday was day 18 for gold, placing it in the early part of its timing band for a daily cycle low. If the dollar is rolling over into another daily cycle decline, an early DCL in gold is certainly possible.

Gold will need to form a swing low to confirm day 18 as the DCL. Gold is currently in a daily uptrend. Reclaiming the 10 day moving average indicates a continuation of the daily uptrend and signals a cycle band buy signal.

Leave a comment