Summary

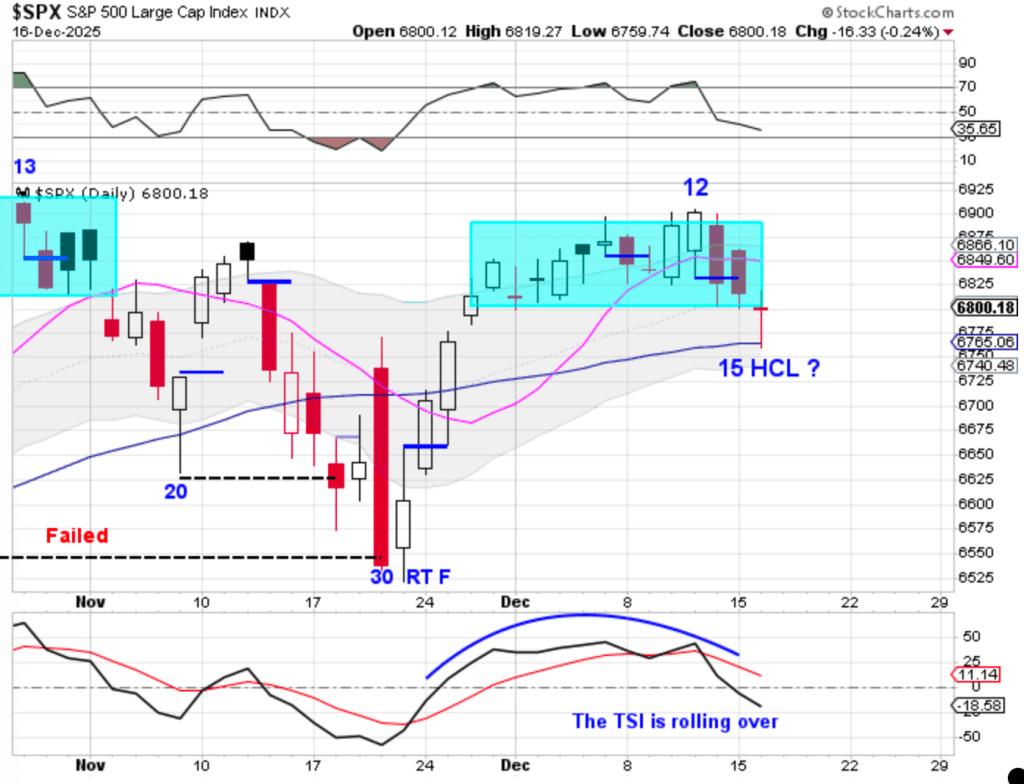

- Stocks have been range-bound between 6900 resistance and 6800 support since late November

- A swing high and close below the 10 day moving average signaled early weakness

- Tuesday’s bearish breakout marks a left-translated daily cycle setup

- The 50 day moving average is now the key near-term support to watch

Stocks have been consolidating between the 6900 resistance level and 6800 support since late November. While stocks formed a swing high and closed below the 10 day moving average on Friday — followed by additional weakness on Monday — price remained contained within the broader consolidation range.

That changed on Tuesday.

Stocks broke bearishly out of consolidation on Tuesday, day 15, confirming downside pressure and reinforcing the risk of a left-translated daily cycle formation. However, sellers ran into immediate support at the rising 50 day moving average, where stocks formed a reversal candle into the close.

The current peak on day 12 keeps the left-translated daily cycle scenario in play. A decisive close below the 50 day moving average would signal the daily cycle decline and confirm that sellers are gaining control.

For now, stocks remain in a daily uptrend. A swing low followed by a close back above the 10 day moving average would indicate a continuation of that uptrend and trigger a cycle band buy signal — in which case day 15 would be labeled a half-cycle low.

Leave a comment