Summary

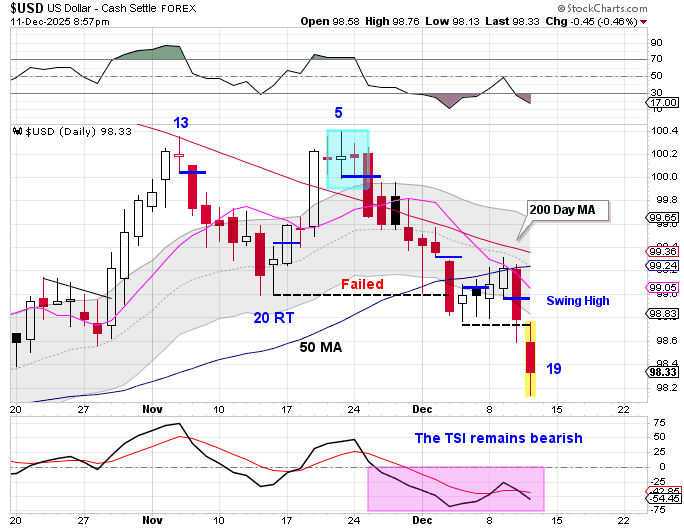

- Dollar

- Rejected at the 10 day and 50 day moving averages on Wednesday

- Formed a swing high with bearish follow-through Thursday

- Still in a daily downtrend

- Swing high below the lower daily cycle band = cycle band sell signal

- Dollar drop fueling precious metal strength

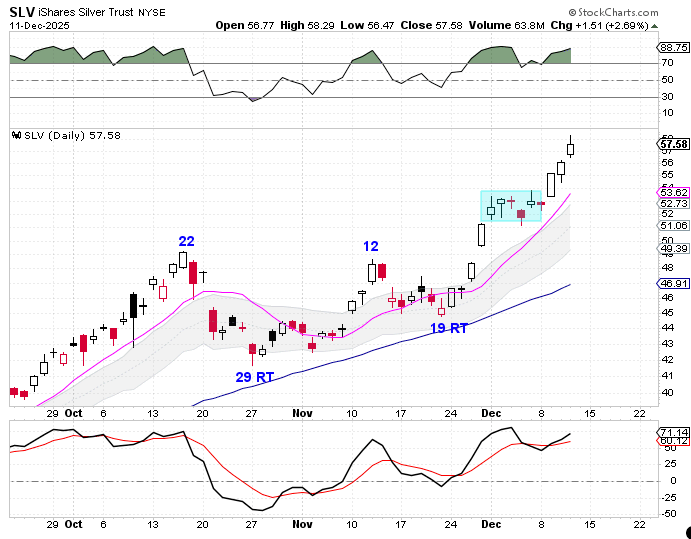

- Silver

- Broke out of consolidation on Tuesday

- Bullish continuation Wednesday and Thursday

- In a daily uptrend

- Breakout = cycle band buy signal

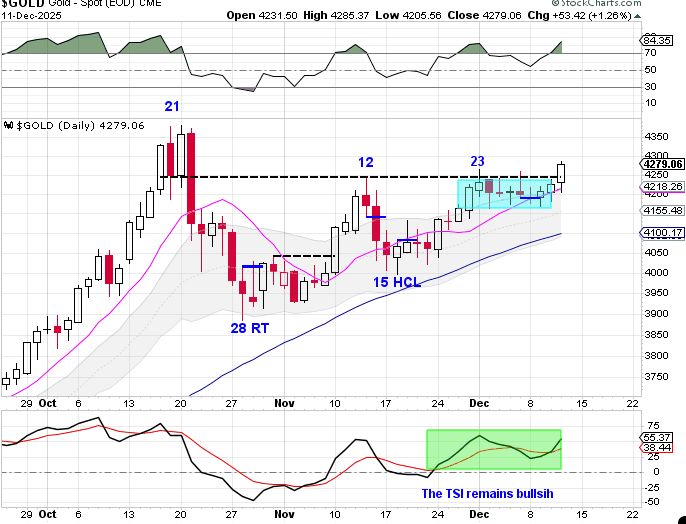

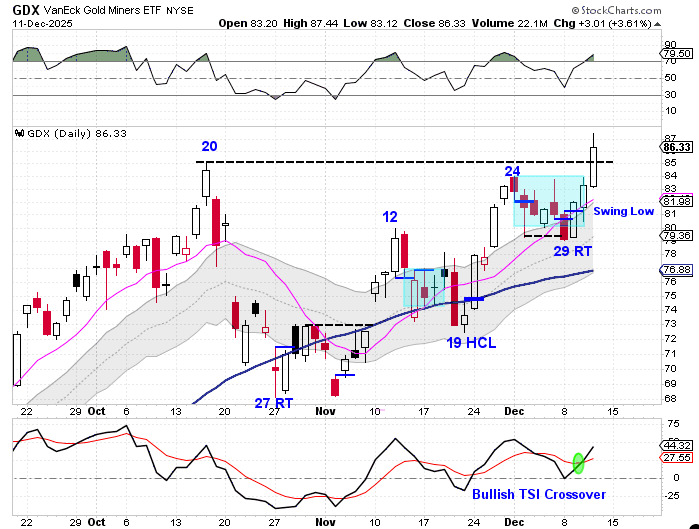

- Gold & Miners

- Both broke out of consolidation on Thursday

- Both remain in daily uptrends

- Breakouts = cycle band buy signals

The Dollar: Rejected at Resistance, Bearish Follow-Through

The dollar had been crawling sideways under the 50 day moving average — until Wednesday. On Wednesday, price was rejected by the converging 10 day moving average and 50 day moving average, forming a swing high. The bearish momentum continued into Thursday, confirming the breakdown. The dollar remains in a daily downtrend. A swing high forming below the lower daily cycle band signals a continuation of the existing downtrend and triggers a cycle band sell signal. The immediate impact of this breakdown has been a strong rally across precious metals.

Silver: Consolidation Ends with a Three-Day Bullish Surge

Silver had been consolidating below resistance — until Tuesday. On Tuesday, silver broke bullishly out of consolidation, and delivered strong bullish follow-through on Wednesday and Thursday. Silver is in a daily uptrend. A breakout from consolidation confirms the continuation of the uptrend and triggers a cycle band buy signal.

Gold and Miners: Bullish Breakouts Hit Together

Both gold and the Miners had been coiling beneath their respective resistance levels — until Thursday. On Thursday, both markets broke decisively out of consolidation, launching bullish continuation moves. Gold and the Miners are each in a daily uptrend. Their breakouts signal further continuation of the uptrend and generate cycle band buy signals for both markets. Stops can be set below the breakout.

Leave a comment