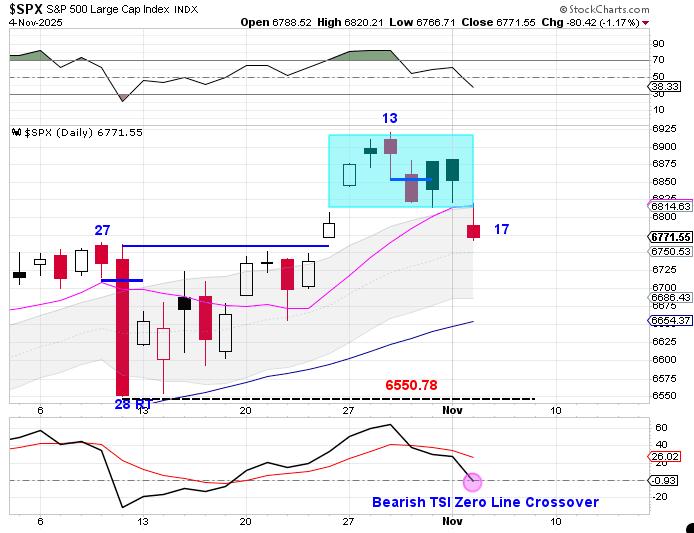

Stocks broke bearishly out of consolidation to close below the 10 day moving average on Tuesday. This action sets up a left-translated daily cycle formation and signals the start of the daily cycle decline. We should now see the 10 day moving average turn lower as the cycle decline progresses.

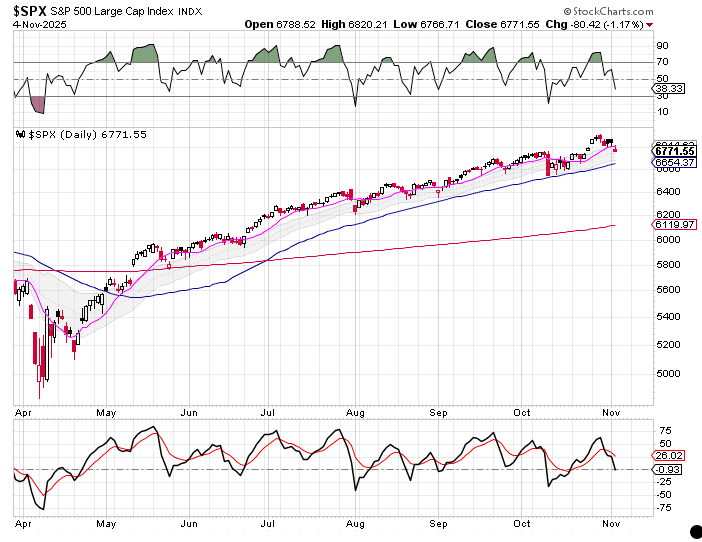

Since emerging from the yearly cycle low back in April, stocks have consistently found support near the rising 50 day moving average. This has been an important technical reference point during each pullback. As stocks enter their timing band for a potential daily cycle low, we’ll be watching to see if the 50 day moving average once again acts as the anchor for the next low.

Stocks remain in a daily uptrend for now. They will stay in that uptrend unless they close below the lower daily cycle band. However, a break below the previous daily cycle low of 6550.78 would confirm a failed daily cycle — which could signal the beginning of a much larger intermediate cycle decline.

Leave a comment