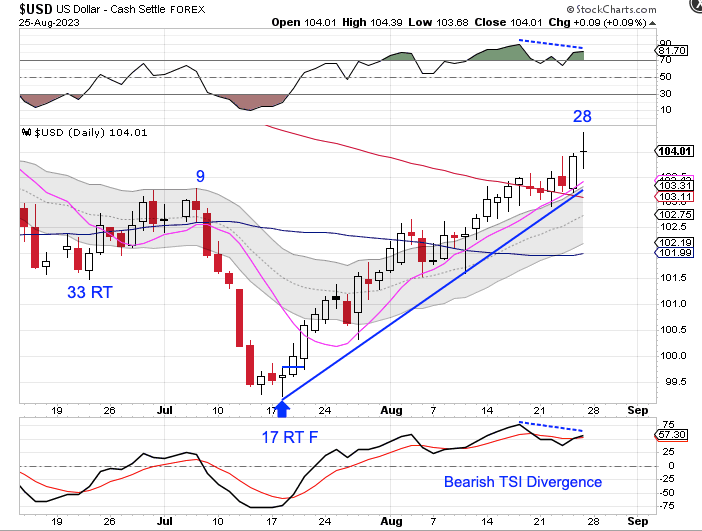

The Dollar

The dollar regained the 200 day MA on Tuesday.

The dollar went on to print a higher high on Friday, day 28. The new high on day 28 locks in a right translated daily cycle formation. 28 days also places the dollar in its timing band for DCL. A swing high and close below the 10 day MA will signal the daily cycle decline. The dollar is currently in a daily uptrend. The dollar will remain in its daily uptrend unless it closes back below the lower daily cycle band.

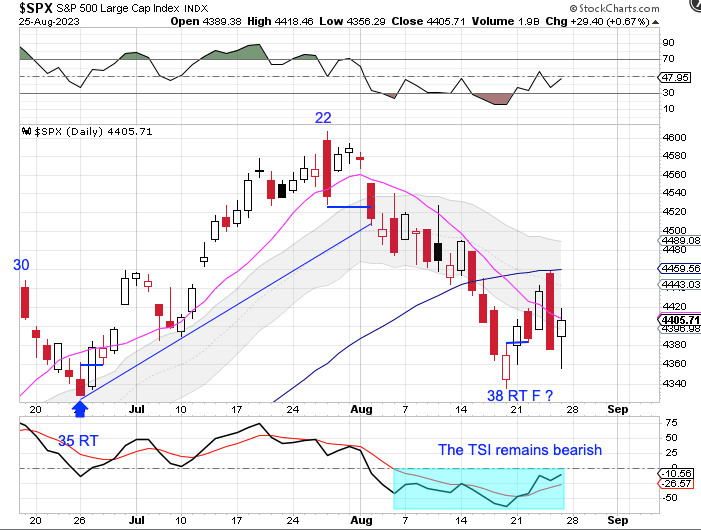

Stocks

Stocks printed their lowest point on day 38 to place them in their timing and for a daily cycle low.

Stocks closed above the 10 day MA on Wednesday but lost the 10 DMA on Thursday. A close back above the 10 day MA will have us re-label day 38 as the DCL. But a break below the day 38 low of 4335.31 will extend both the daily cycle and intermediate cycle declines. Stocks are currently in a daily downtrend. Any bearish follow through will indicate a continuation of its daily downtrend and signal a cycle band sell signal.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.

Leave a comment