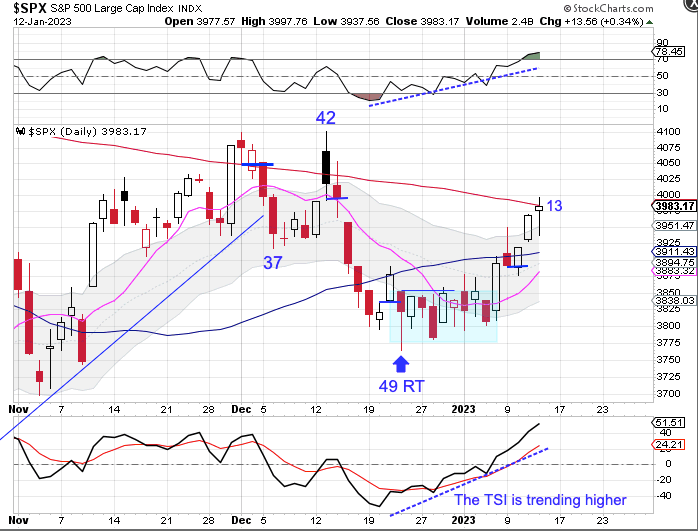

Stocks managed to close above the 50 day MA on Tuesday then delivered bullish follow through Wednesday and Thursday — being halted that the declining 200 day MA.

This is the first attempt to break above the 200 day MA during this daily cycle. The previous daily cycle did make several attempts to break above the 200 day MA. Those attempts occurred late in the timing band for a DCL, which lowered the odds of a successful breakout. At day 13, stocks have plenty for a breakout and bullish follow through. Stocks are now in a daily uptrend. A close above the 200 day MA will indicate continuation of the daily uptrend and signal a cycle band buy signal.

Leave a comment