We discussed on Thursday that stocks need to close above both the 200 day MA nd the 10 day MA to signal a new daily cycle. On Friday they came close, but no cigar.

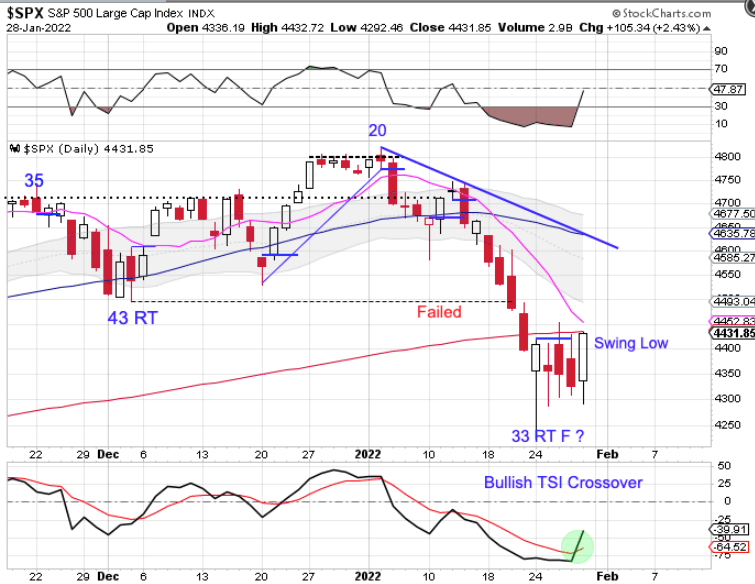

Monday was day 33 for the daily equity cycle, placing stocks in their timing band for a DCL. While stocks formed a swing low on Wednesday and printed a bullish reversal on Friday, they remain contained by the 200 day MA. With the 10 day MA converging on the 200 day MA, we are still waiting to see a close above both the 200 day MA and the 10 day MA to signal a new daily cycle.

Leave a comment