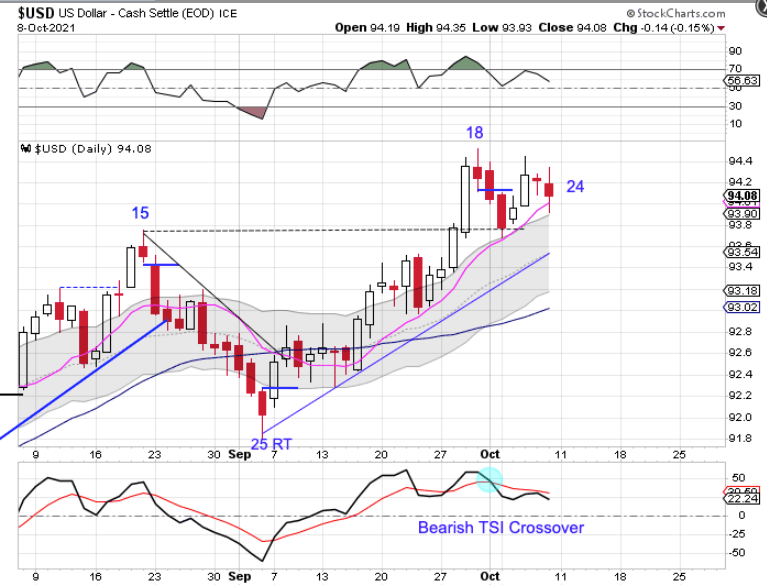

The Dollar

The dollar peaked on day 18 and has since consolidated above the breakout from the previous daily cycle high.

Friday was day 24, placing the dollar in its timing band for a DCL. The weekly chart shows us that the dollar is running into resistance at the 200 week MA. A close below the 10 day MA will signal the daily cycle decline. The dollar currently is in a daily uptrend. The dollar will remain in its daily uptrend unless it closes below the lower daily cycle band.

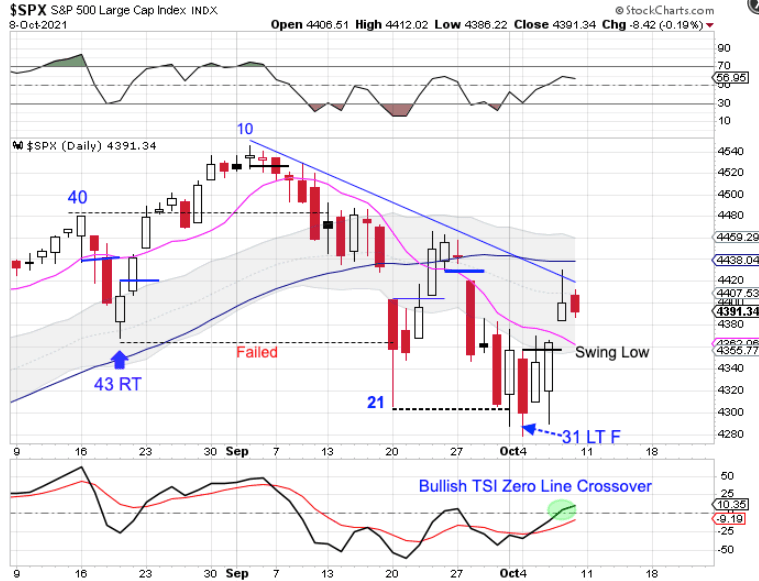

Stocks

Stocks printed their lowest point on Monday, day 31, placing them in their timing band for a DCL.

Stocks formed a swing low on Tuesday then closed above the 10 day MA on Thursday to signal the new daily cycle. Stocks should go on to break above the declining trend line as they rally out of the DCL. Stocks are in a daily downtrend. They will remain in their daily downtrend unless they can close back above the upper daily cycle band.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker,

For subscribers click here.

Leave a comment