Stocks broke below the previous daily cycle low on Monday. Breaking below the previous daily cycle low forms a failed daily cycle and confirms the intermediate cycle decline.

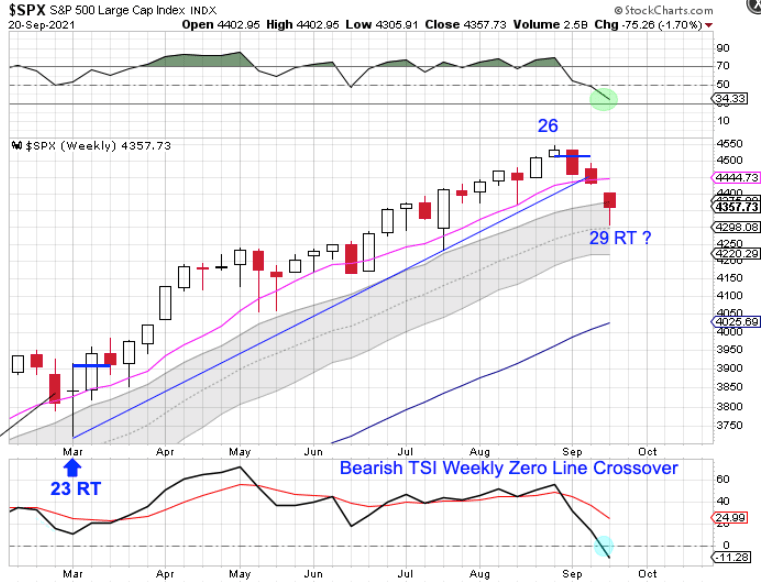

Stocks are on week 29 for the intermediate cycle. This places them very deep in their timing band for an intermediate cycle low. The odds are very good that once a daily cycle low forms, that it will also mark the intermediate cycle low as well.

Stocks are currently in a weekly uptrend and are already in the process of forming a bullish weekly reversal. If stocks form a weekly swing low above the lower weekly cycle band then they will remain in their weekly uptrend and trigger a weekly cycle band buy signal.

Leave a comment