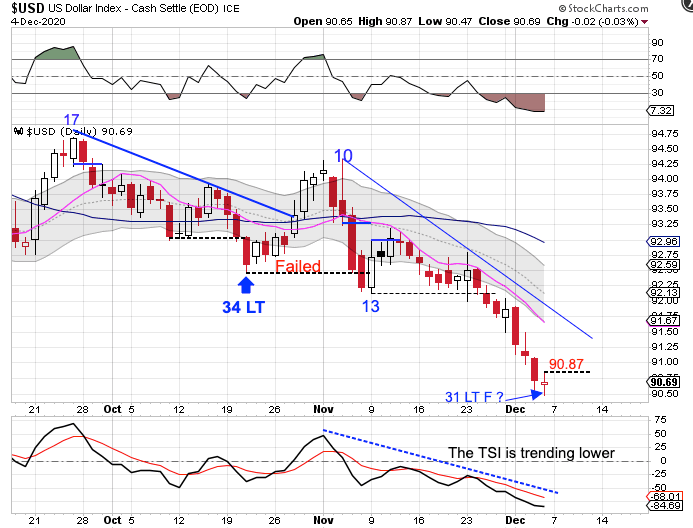

The Dollar

The dollar continued lower to print its lowest point on Friday.

Friday was day 31, which places the dollar in its timing band for a DCL. The narrow range day eases the parameters for forming a swing low. A swing low and close back above the declining trend line will signal a new daily cycle. A break above 90.87 will form a daily swing low. Currently, the dollar is in a daily downtrend. The dollar will remain in its daily downtrend until it can close back above its upper daily cycle band

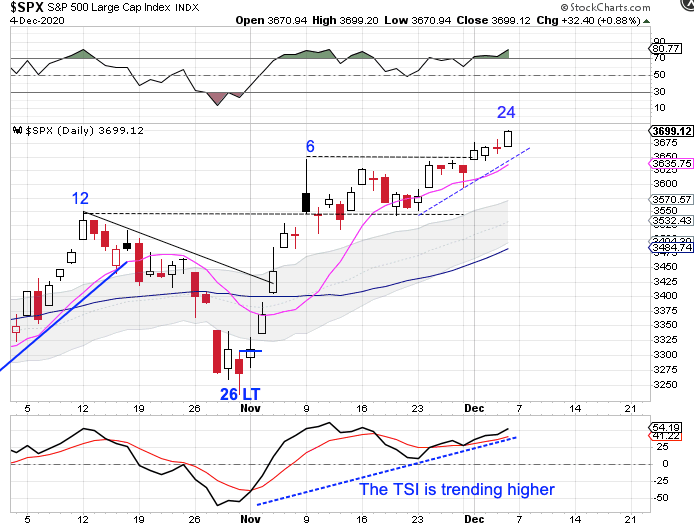

Stocks

Stocks broke above the day 6 high on Tuesday and continued higher through Friday.

A new daily cycle high on Friday, day 24, locks in a right translated daily cycle formation. Breaking above the day 6 high sets stocks up for a second leg higher during this daily cycle advance and we will construct an accelerated (blue dashed) trend line to monitor. Stocks are in a strong daily uptrend and may have just started a possible melt up into a bubble scenario.

The entire Weekend Report can be found at Likesmoney Subscription Services

The Weekend Report discusses Dollar, Stocks, Gold, Miners, Oil, & Bonds in terms of daily, weekly and yearly cycles.

Also included in the Weekend Report is the Likesmoney CycleTracker

For subscribers click here.

You can email me at likesmoney@gmail.com to receive a sample copy of the Weekend Report

Leave a comment